Earnings season may be winding down, but a few standout names could still make headlines this week. If you’re looking for potential moves, keep an eye on these three stocks — Dollar Tree, Inc. (DLTR), CrowdStrike Holdings, Inc. (CRWD), and Broadcom, Inc. (AVGO).

Each of these names is at a pretty interesting inflection point right now. It might be worth waiting to see how things play out before making any big bets.

Dollar Tree (DLTR): Quiet Comeback with Room to Run?

Dollar Tree (DLTR) broke out of a long-term downtrend and, as of the last quarter, is back above key moving averages. Many of the beaten-down discount chains, such as Five Below (FIVE) and Dollar General (DG), have started to reverse major downtrends. This week, we will see if earnings momentum can keep going, as DLTR stock has rallied 21% year-to-date.

Investors will be looking for insight into how DLTR is navigating the transition after the $1 billion Family Dollar sale (yes, they paid $8.5 billion in 2015) and how its core stores are performing in the current economic environment. The last two quarters have been relatively calm, as DLTR stabilized with minor gains of 3.1% and 1.9%. That stability comes after a three-quarter losing streak, with average losses of -13.7%.

From a technical standpoint, DLTR made its big move in mid-April as it broke out of a longer-term neutral range and a long-term downtrend. The stock price has eclipsed the 50- and 200-day moving averages and seems to be back on the right track.

The breakout of the rectangular bottom gives an upside target of roughly $98 a share, so there is room for DLTR to run. That move would fill the gap created last September and bring shares into a stronger resistance area around $100. On the downside, there may be an opportunity to enter DLTR, as we have a potential scenario where old resistance becomes support, giving an entry level around $79.50/$80. That would be a good risk/reward set-up for those who may have missed the initial breakout.

Overall, the stock still has room to run, but most of this upside move may already be in the stock, as the price approached an overbought condition with much overhead resistance ahead.

CrowdStrike (CRWD): Heating Up Before Earnings

CrowdStrike (CRWD) has returned from the ashes after last year’s Delta Air Lines, Inc. (DAL) computer outage that caused over 7000 cancelled flights. As it heads into this week’s earnings, shares are trading just under all-time highs.

The cybersecurity company has seen shares decline over the past two results, but that hasn’t stopped its continued momentum. The stock averages a one-day move of +/- 8.5%, so expect volatility.

Technically, CRWD comes into the week at an intriguing pivot point. After breaking out to new highs, the stock pulled back to its old resistance areas from which it broke above. Will old resistance become support, or are we looking at a potential bull trap?

The relative strength index (RSI) indicates there may be room to run. We have seen some extreme overbought conditions in the past, and we are not there yet. A solid beat and guide could see additional momentum in what continues to be one of the top stocks within the cybersecurity sector.

Speaking of strength, CRWD is shining on a relative basis. It’s up 36.7% year-to-date, outperforming CIBR, the biggest cybersecurity ETF in CIBR, which is up 12.8%. That said, downside risk could be steep given the recent run. Stepping in front of this stock ahead of results could be costly. On weakness, wait for a better risk/reward entry and look for support just around $405.

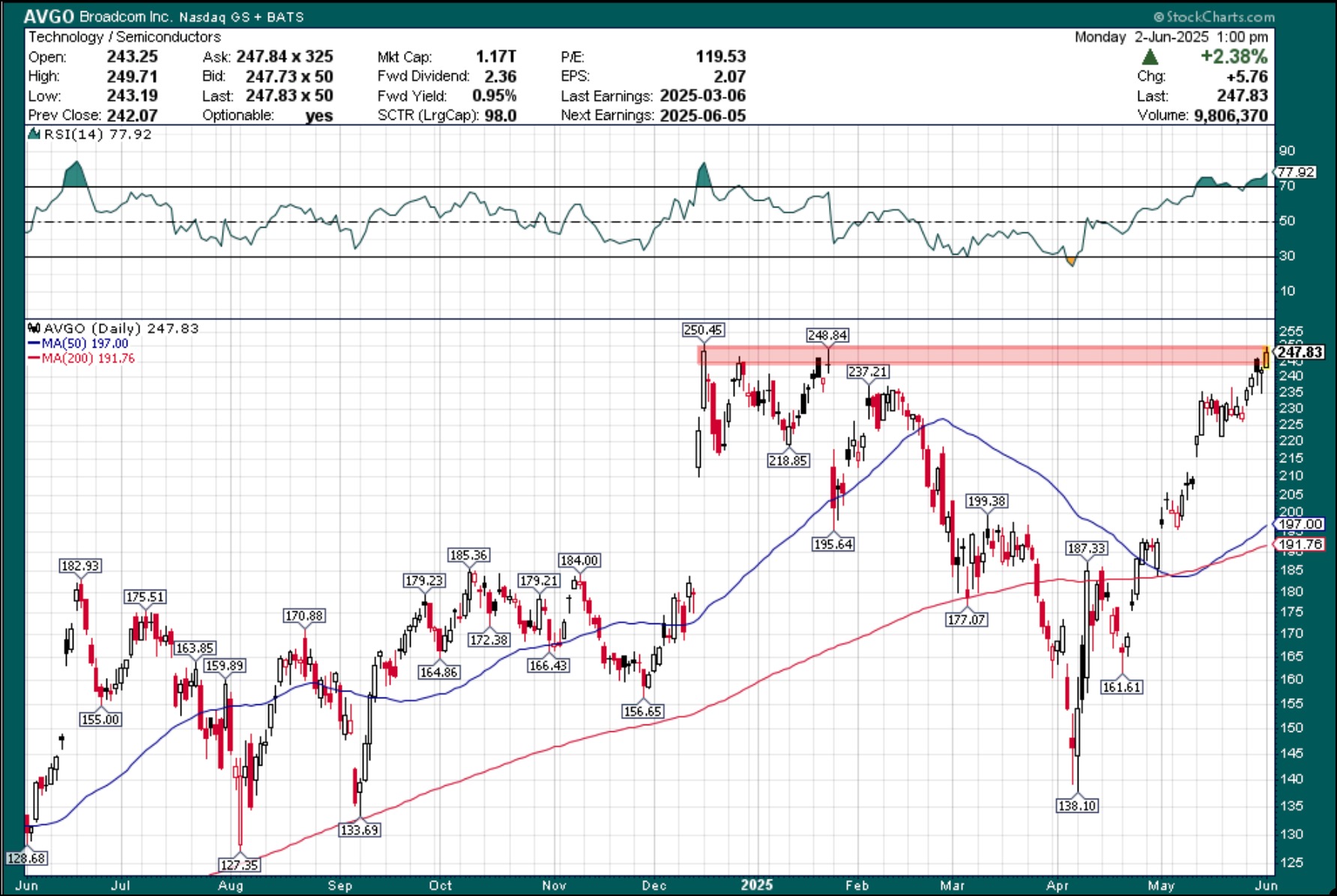

Broadcom (AVGO): Ready to Step Out of Nvidia’s Shadow?

Broadcom (AVGO) is Nvidia’s baby brother. It is in the $1 trillion market cap club, a top holding in both the Semiconductor ETF (SMH), the Technology ETF (XLK), and the Nasdaq 100 (QQQ).

AVGO has grown mightily in NVDA’s shadow for years now. Shares have rallied just over 500% from their 2022 lows, which pales to the 1250+% rally in Nvidia. However, over the past 52 weeks, AVGO shares have risen 82% compared to Nvidia’s 23% gain.

Now that we’ve seen how price action settled out with NVDA, what could this mean for AVGO?

Technically, if AVGO wanted to step out of NVDA’s shadows, this would be the chance to do so and lead the semiconductors higher. However, momentum is waning, and we continue to see large caps struggle to make new highs.

The table is set for a potentially large breakout. AVGO is at a key resistance area just under $250. It couldn’t break through it last week, but could earnings be the catalyst for getting it over the top? Given the overbought conditions and tough market environment, it should be a challenge. You may be able to buy this stock on a dip and wait for the rest of the market to catch up as we look for more clarity on tariff policy. Look for a pullback to the $220 area to add to or enter the name.

Long-term investors should ignore the noise to come. AVGO has suffered through the worst and should break out in due time. It just may not be this time.