Relatively healthy earnings reports from the big banks and a June inflation report that came in line with analyst expectations didn’t give the stock market much of a lift, as the S&P 500 ($SPX) and Dow Jones Industrial Average ($INDU) both ended the day lower. The only major index to shine was the Nasdaq Composite ($COMPQ), which closed at a record high.

Technology stocks were the stars of the show. It wasn’t a blowout rally, but the sector still managed to finish in the green. Why? There were a couple of key developments that gave tech a nice boost.

First, semiconductors got some breathing room. Restrictions on chip sales to China were relaxed, and that gave big names like NVIDIA Corp. (NVDA) and Advanced Micro Devices (AMD) a reason to rally.

Second, there’s a push from the government to invest in AI and energy initiatives in Pennsylvania. One of the biggest winners was Super Micro Computer, Inc. (SMCI), which jumped 6.9% — the biggest percentage gain in the S&P 500. You can see from the StockCharts MarketCarpet for the S&P 500 stocks that, besides the top-weighted stocks in the index, it was mostly a sea of red.

FIGURE 1. MARKETCARPET FOR TUESDAY, JULY 15. Technology was the clear leader, with the largest cap-weighted stocks leading the sector higher.Image source: StockCharts.com. For educational purposes.

Semiconductors Show Strength

If you’ve been watching semiconductors, you may have noticed that the SPDR S&P Semiconductor ETF (XSD) has been on a roll. Since April, the ETF has stayed above its 20-day exponential moving average (EMA). The relative performance of XSD against the SPDR S&P 500 ETF (SPY) has been improving, and its relative strength index (RSI) is at around 62, an indication that momentum is at healthy levels (see chart below). It’s important to note that since May, the RSI has remained above 50, which is supportive of XSD’s upside movement.

Note: StockCharts members can access this chart from the Market Summary page or the Market Summary ChartPack (under US Industries > Bellwether Industries).

FIGURE 2. DAILY CHART OF XSD. Since April, XSD has been trending higher and is now trading above its 21-day EMA.Chart source: StockCharts.com. For educational purposes.

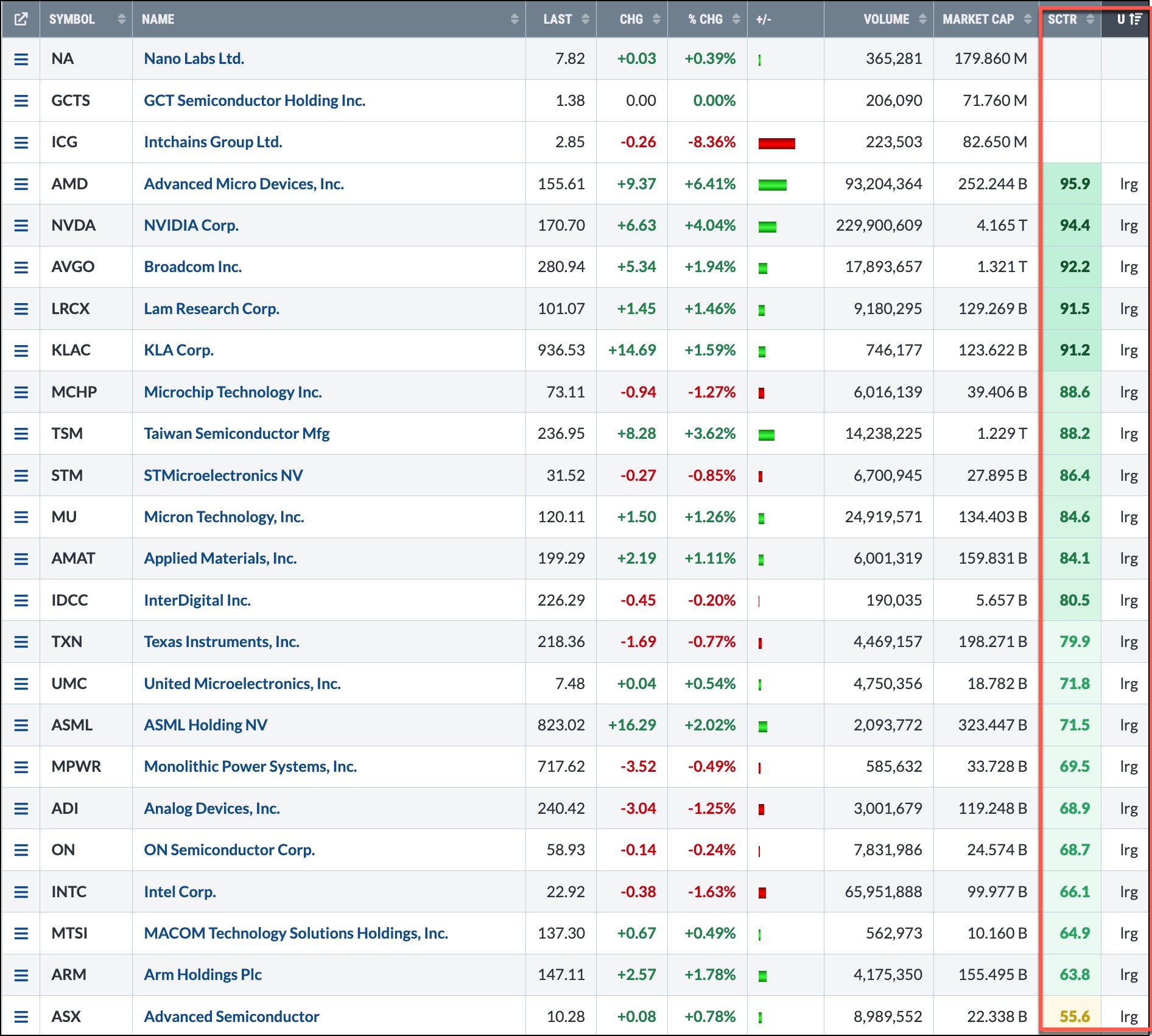

How to Track Semiconductor Stocks

If the environment for semiconductors remains strong, there could be more upside for stocks in that space. A simple way to keep tabs on the stocks using StockCharts tools is to create a ChartList of semiconductor stocks you’re interested in owning.

- Begin by heading to the US Sectors panel in the Market Summary page or the Sector Summary page on your Dashboard.

- Click Sector Drill-Down > Technology Sector Fund > Semiconductors.

- You’ll see the list of semiconductor stocks that make up the industry group.

From there, I prefer to sort the data by the Universe (U) column, starting with the large caps and then the StockCharts Technical Rank (SCTR) score to find large-cap technically strong stocks. You can then view the charts on the list. If you see a chart that appears to have a favorable risk-to-reward ratio, you can save it to your Semiconductor ChartList.

FIGURE 3. SEMICONDUCTOR STOCKS TO REVIEW. The sector drill-down will uncover stocks in leading sectors or industry groups. Scroll down the list to identify charts that meet your investment or trading criteria. Image source: StockCharts.com. For educational purposes.

As you review the charts in your ChartList, you can identify potential support and resistance levels and set alerts to notify you when prices reach your key levels. It’s a great way to stay proactive.

The Bottom Line

This type of top-down analysis helps you stay one step ahead of the market. Start with the broad market, then narrow down to sectors, then industry groups, and then individual stocks. By taking a proactive approach to managing your investments, you’re always preparing for the stock market’s next move.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.